Sales forecasting

and inventory optimization

Become a retail mastermind you always wanted to be.

Become a retail mastermind you always wanted to be.

By: Jul Domingo

According to the US Census Bureau, the average inventory-to-sales ratio at the end of September 2021 was 1.26. That shows that most businesses hold $1.33 of inventory for every $1 they sell.

Given the $0.33 average excess inventory for every $1 of your assets, finding out how to save your small business from unsold inventory can be valuable.

If you don’t want to lock up your cash by leaving old items to collect dust on your valuable warehouse space, understanding the causes and ways to prevent dead stocks is your best next move.

Dead stocks (or obsolete stocks) are the growing piles of unsold inventory in your store. At first, SMB owners mistaken them for slow-moving products. But most of these goods turn into dead stocks when the demand for them drops to zero.

Understandably, buying inventory is like any other type of investment. There’s still no guarantee of generating a profit—but it’s important to work on reducing your dead stock. The goal is to eliminate it with as little collateral damage as possible.

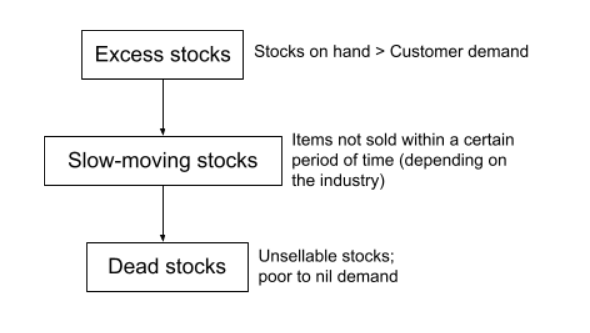

Physical store and ecommerce business owners must distinguish between excess stock, slow-moving products, and dead stock before working on getting rid of dead inventory. Let’s look at some helpful definitions:

Dead stock refers to the number of items in the stockroom or warehouse shelves that are no longer sellable.

Excess inventory is simply the surplus inventory on hand. Excess stocks, if sold within a long time, can become slow-moving stocks.

Slow-moving products are items sold within longer inventory days’ turnover. But it’s important to note that products operate at different life cycles. For example, around 5 to 7 days are a bad inventory days’ turnover for grocery stores but are ideal for boutique shops.

Regardless of whether an excess or a slow-moving inventory exists, prompt management actions will help prevent dead stock.

As a rule of thumb, dead stock refers to products that haven’t been sold for at least one year. New products have different timeframes. For example, you can give them 90 days to prove their viability. If there is no movement after this period, they have a large dead stock potential.

Inventory becomes dead stock items once they reach the point of nil demand. Due to prolonged storage and inferior quality, these items are not likely to sell. It can range from defective products, leftover seasonal items, or raw materials that have reached their expiration dates.

Here’s an illustration of the inventory life cycle:

From being a regular excess stock, inventory becomes slow-moving if it isn’t sold within its ideal turnover period. But when the inventory sits longer on your store shelves and officially becomes unsellable, rendering it dead inventory.

Preventing dead stocks requires you to be on the lookout right at the beginning. Create several plans for dealing with excess stocks in the future.

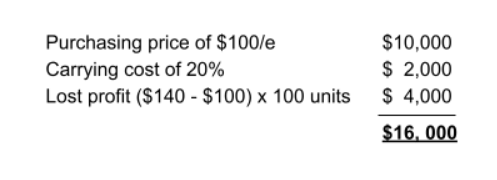

Holding an uncontrollable amount of dead stock has a direct impact on your cash flow. To understand what is the example of dead stock in the business world and the cost of not preventing it in your company, here’s a theoretical example:

This means those 100 units of dead stocks for one product amounts to a whopping $16,000. See the breakdown below:

These numbers only cover one product type. If you have a variety of dead stock products in your roster, the loss will be greater. Not only that, David Reid, Sales Director at a mold manufacturing company called vem-tooling.com, insists it’s just the tip of the iceberg, “If our business can’t sell a hundred units of a product, each with a $50 retail price, the agency theoretically loses $10000 in anticipated revenue. However, other essential costs are much harder to quantify.”

Dead stock items can be anything from unsellable excess stocks, seasonal items, and defective products. Below are the three common reasons why companies accumulate obsolete inventory over time:

Decline in customer demand. Dead stocks occur when economic and technological shifts change customers’ product preferences. Some examples are:

Poor inventory management. Dead stocks are more likely to happen with a lack of inventory management software and poor inventory strategies. Restaurants, for instance, have shorter shelf lives for their products, so food waste and bad produce are inevitable if they don’t monitor how much and when they need food supplies. Another key reason is lack of proper inventory forecasting. A lot of entrepreneurs fall into this trap because they don’t know the financial and business implications of dead stock.

Sunk cost fallacy. Some business owners stubbornly hold onto a failing investment due to the time, effort, and money they have already invested. No, they won’t discount the non-moving products yet. With fingers crossed the company keeps the products longer in the hope that someone will eventually pay full price for them. But the longer the items stay on store shelves, there’s a high chance they’ll end up being dead stocks.

Lack of attention. The top sellers get all the attention, but deadstock sits somewhere at the back. Entrepreneurs rarely give value for their stale inventory, if they think their best sellers are making up for the loss. The longer you ignore it, the worse it gets until it is beyond redemption. Is it possible to get rid of deadstock? Yes, but you need to invest time and effort clearing the dusty corners of your warehouse.

Selling your dead stock to make profits is a short term strategy. It ensures you don’t lose your business but at the same time, it has zero guarantee of reducing future occurrences.

Avoiding surplus inventory is the ultimate key to preventing dead stocks. Leverage these 7 simple strategies and see how they can impact your bottom line:

Inventory management strategies like ABC analysis can rank your best-selling to least-selling inventory. It’s a simple tool used by small retail business operators and large global retail megacorporations alike because it does a great job categorizing your stock into three simple categories based on profit and making thresholds.

Here’s how we sort inventory in Inventoro:

Finding out what caused your predicament will help you to move forward so that it won’t repeat itself. As soon as you identify the less profitable ones, you can monitor them and turn them into sales.

Identifying the root causes of dead stock inventory is the most important step to fixing it in the long term. Common root causes include:

Once you know what the real reason behind your dead stock inventory is, you can decide if it makes sense to invest more in it. In many cases, it’s pointless to invest in obsolete inventory.

However, some products fail to sell due to a lack of visibility. If you discover your products have suffered from poor marketing strategy and product placement. Business consultant Kamyar Shah suggests, “work with your marketing team to make sure that your dead stock is more visible, giving these products a chance to be sold.”

Another example is when businesses also assume that they’ll sell more of a certain product during the holidays that will be unusable afterward, according to Steven Vigilante, soda brand OLIPOP’s Head of New Business Development. While this product might sell next holiday, it’ll sit on your shelves for an average of 8 months.

Segmenting your products helps you track past performance, which you can use to predict future sales trends. Product forecasting helps you determine how much you need.

Eyelash company The Blink Bar’s CEO Tirzah Shirai, has had troubles with incorrect forecasting. “Some examples of dead stock in my business include certain types of eyelash glue and lashes that can’t no longer be used. This can cost our business hundreds or even thousands of dollars,” she explains.

After realizing that a certain product is not selling as you expected, update your forecast right away. Better yet, let a reliable sales and inventory forecasting platform do it for you. Saving time is a big plus for busy entrepreneurs.

“Improper forecasting is one of the leading causes of dead stock, with businesses overestimating demand for product trends that quickly go out of style. Finding the right formula for the sweet spot in preventing both stock outs and dead stock takes trial and error, and can be different for different products.”

– Meaghan Brophy, Retail Specialist at Small Fit Business

When the time to replenish inventory rolls around, ensure that the dead stock item isn’t a priority. Both product segmentation and accurate sales forecasting can see to this, but it’s also much better for your company to streamline its purchasing process so that you only purchase or manufacture what you need.

It may seem like second nature that when you find out your product isn’t doing well, you won’t ask for a new batch from your supplier. But as a business owner, you’re putting out a lot of fires. It’s hard to keep information about product performance in your head at all times and make sense of it come replenishment time.

“One way to do this is to streamline communications across your business,” suggests Pavel Liskin, CMO at QVALON, a retail management solution. If you manage a handful of people in your business, have your warehouse team and management on the same page by improving communication protocols.

In the case of small and medium-sized businesses, an automated replenishment process is the best solution to ensure dead stock items are left out when adding new inventory.

Mitigate the risk of dead stock items by negotiating with your suppliers. Most of them offer buyback agreements in order to keep your business. But in the case of stale inventory you can flip the table and send the detailed buyback proposal to your suppliers.

Aim for specificity here and avoid vague terms. Suppliers are partners, and you want your negotiations to result in a long-term relationship. Document everything because written contracts are legally more flexible than undocumented agreements.

Avoid dead stock by knowing the needs and wants of your customers. Start by conducting market research and demand analysis to test the waters before launching new products. This way, you can understand their current purchasing behaviors and expect demand changes in the future.

Not sure how to ask for customer feedback? Here’s a sample from Rocks & Co. asking their customers to fill out a survey via email:

Source: Milled

Providing quality products is also another way to prevent dead stock. Gauge your customers’ needs but also ensure their satisfaction by requesting feedback. It will help you counter quality issues that are common reasons for the decline of demand.

A manual inventory system is ideal for startups and some businesses with slow moving products, such as a jewelry store. But when you have several fast-moving products like a grocery store, manual recording becomes quite tedious and time-consuming. Insufficient inventory control, like poor inventory records, can lead to the oversight of dead stocks.

Investing in a smart inventory management system is your best resort to cut dead inventory. With real-time monitoring and smart demand forecasts, you can track product performances and make data-driven decisions moving forward.

Dead stocks simply mean lost profit. Retailers often stock up so much (and sometimes, bad) inventory and then ignore them for a long period. Their resort is always to sell them out as bundles or at a salvage price—and that doesn’t even work all the time.

With Inventoro, it’s possible to get rid of dead stocks in just a few clicks. Access the product segmentation of your portfolio and act fast on slow-moving items, and filter your dead inventory by warehouse, category, or even by single SKU.

Another way to avoid dead stock is to automate forecasts. Proper forecasting requires knowledge of different algorithms and techniques to produce accurate predictions. Using our automated sales forecasts, you can ensure that you have the right amount of productive stock on hand, preventing unwanted inventory.

Last but not least, set up an intelligent replenishing system. Supply questions come up constantly to avoid dead stocks when processing orders. Inventoro automates the process while putting the results of our predictive analysis into consideration.

Try Inventoro today and bring an end to your dead stock cycle.

Become a retail mastermind you always wanted to be.