Sales forecasting

and inventory optimization

Become a retail mastermind you always wanted to be.

Become a retail mastermind you always wanted to be.

By: Jul Domingo

Planning for the future can be daunting. It’s a general truth, but especially true when planning your business.

The process is too complex, involving a lot of moving pieces in areas such as finance, logistics, and product management. And these three concerns are just the tip of the iceberg.

At the center of all this is one principle that governs all your business goals: increase profits while reducing costs.

As global challenges extend through 2023, hammering out a business plan that ticks all the boxes has proven more challenging than normal.

To help you overcome your difficulties and kickstart your business success, we identified four steps to planning your business and highlighted some key areas that Inventoro can support.

Write down your goals and your current state. It may seem like a trivial move, but analyzing how far along you need to go gives you a clearer course of action.

Polish your goals by making them SMART (specific, measurable, achievable, realistic, and timely). This includes going over the profitable steps you’ve taken and checked how your current resources tie up to your goal.

You want to aim higher, but still, keep your next business objectives in perspective.

The year 2023 calls for a holistic approach to business planning. There’s a lot of unpredictability and most consumers look forward to an omnichannel shopping experience involving traditional and digital shopping. Knowing where to serve your customers is a smart move.

Each year should be better than the last, so including an operational improvement is a given. After listing out your 2023 business goals and reviewing the current state of your system, it’s time to get granular and map out which areas demand attention. These include:

Set big goals, but break them down into smaller goals. Big goals transform your business, while small goals make for quick wins that set the gears in motion, helping you build confidence and inspiring you to achieve more. Quick win tasks often require a little budget and minimal effort.

Let’s say, your goal is to increase your newsletter subscription by 25% this year. A quick win would be to find a strategic place to put the subscribe button.

Tip: Your team, irrespective of size, can assist you in these areas, so sit down with them and seek their feedback. You’ll gain a lot of insight from these interactions, and find the right person to spearhead your new initiatives for the year.

It’s rare to come across a business owner who is enthusiastic about budgeting or handling finances, but it’s something you need to foray into to work on your profitability. Set a business budget that covers your fixed costs, variable expenses, and contingency fund.

Fixed costs are your recurring costs. An example is a website hosting fee or physical space rent.

Variable costs fluctuate based on your needs. A prime example is marketing costs, which have a lot of nuts and bolts attached to them. Identify the allocation of funds to various platforms so you can effectively market to–and capture the attention of–your ideal customer. Determine optimal funding levels needed for each platform in order to reach your goals.

Last but not least is your contingency plan. Last years, mainly 2020 and 2021, COVID-19 posed unpredictable challenges, especially in terms of shipment delays.

But even in the absence of a pandemic, situations such as a war, a natural disaster or losing a significant customer base still exist. These can render your “rainy day fund” a key factor in your business’s survival and failure.

Take a look at your cash flow statement and assets, and devise a plan for when money is scarce or if your business takes a wrong turn. Some ideas include keeping cash reserves or having a large line of credit (we’ll discuss how we can help in a moment).

Budgets and financial plans go hand-in-hand. Your financial plan will progress faster if you stick to your budget.

So your business plan for 2023 won’t be a success without a solid financial plan, one that ties the state of your business to the current and future economic conditions.

To do this, you must look back at last year’s expenses. Think about whether all your investments are worthwhile, or whether you need to put more money into some areas next year and less into others. Refer to your 2023 business improvement plan. If you’ve checked all the boxes, the answer won’t disappoint.

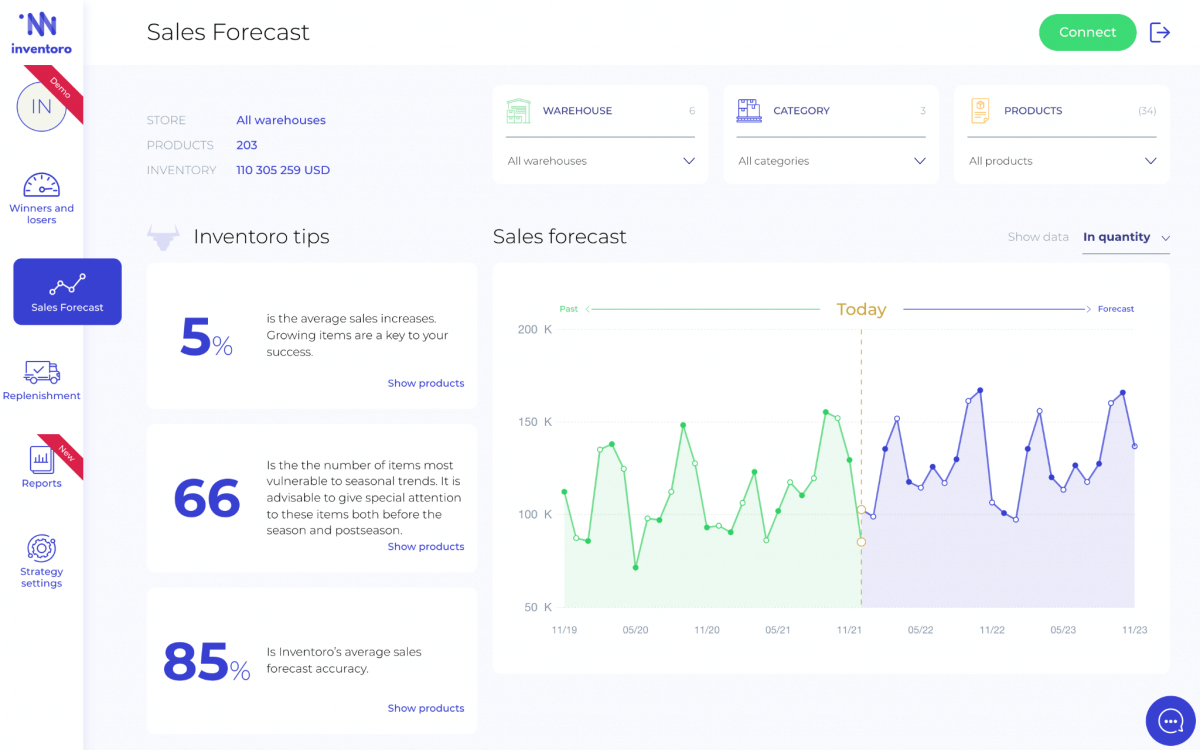

Small business financial plans have a lot of components (think: income statement, balance sheets, projections, assets, and liabilities), but there’s an impactful one that Inventoro provides an innovative take on: sales forecast.

Our tool is a cut above the rest, allowing you to predict sales up to an accuracy of 80%. Not only that, but we even have other features you can use to develop your business plan, like product segmentation.

And this is the kicker: when you sharpen your sales forecasting prowess and product segmentation capabilities, you also improve other aspects of your business, such as:

Inventoro system can predict your product performance for up to two years in advance. You can use this knowledge to communicate your future needs to your suppliers, so you’ll end up with the products that you need for less than a price.

Imagine you need to purchase 9,000 shirts over the course of 3 months based on your sales forecast. This allows you to renegotiate terms with your suppliers than if you were buying 3,000 per month. It’s technically the same amount, but the guarantee will do the trick since suppliers want to lock in their business.

Inventoro also allows you to organize your suppliers and determine how much of their goods you need every month.

Looking to make some big changes to your business? Perhaps you want to introduce new products or adopt sustainable business processes? Instead of taking the costs out of pocket, show the bank how promising your business is.

Our forecasting tool has heightened accuracy, giving you–and the bank–a clear view of how much you can sell in the future.

Take note that the accuracy level changes per item, especially with seasonal products–because we need more data to work on.

Use the highly accurate items to show your bank how much potential you have. Most banks want to see your last year’s numbers. But last year’s numbers don’t have a future market and economic trends layered in, making them insignificant during COVID-19. Since the situation has created a sense of unpredictability, your previous numbers are no longer effective in portraying the state of your company or its potential

Because there’s a certainty to which we know this, represented by the percentage section (see picture above) the loan request becomes more future-oriented. It changes the dialogue between you and the bank–and they know it too. It reduces the risk for them because getting financing options based on past sales data doesn’t represent your growth.

For Czech clients, we have a direct API to a financing company that offers loans based on our data. Sales history is a thing of the past. Our innovation has twisted the narrative and has prompted some financial institutions to become forward-thinking.

No one likes goods gathering dust on their shelves, but sadly most business owners concentrate on making a winning product portfolio. But if they take a step back and look at the full picture, they realize their dead stock is the deadweight holding their potential back.

If you’re in the same boat, you can work on turning those dead stocks into cash or getting rid of them for good.

Inventoro helps you delist the losing products in your portfolio. Inventoro identifies products that no longer meet the desired profile for your company.

Once you delist them, you’ve freed up the funds tied to them, giving you more opportunities to invest.

With Inventoro’s product segmentation feature, you can determine which investments are worthwhile: the chasers and the winners.

Chasers represent the bulk of your portfolio that shows a lot of promise. They also round up your portfolio, which is good in today’s market. Customers prefer to buy everything from one online or a physical store offering a wide range of products. To this extent, chasers work to increase customer satisfaction.

And here’s a catch: most shoppers walk in with an intention to buy a chaser, but walk out of the shop with a winner.

Maintaining a good portfolio of chasers, allows you to cast a wider net that can attract the right customers. By knowing which products fall into this category, you’re better able to identify products with potential and invest in them.

Inventoro tip: We advise you to look at your portfolio once a year to give you a clue about what you can sell in the future.

Then there are winners, which account for the bulk of your sales. If you identify them, you can increase their prices–it may be a logical move, but identifying your profitable products is the challenge because it varies depending on your strategy.

What type of organization do you want to be? There is no right or wrong approach, but your answer dictates your strategy.

Inventoro has strategy settings that influence product segmentation. You can adjust the forecast depending on what drives you as a company: profit, revenue, sales frequency, and sales quantity.

What does this mean? As your goals change, so does the segmentation. They vary because we determine which products support your chosen strategy. That’s how smart our platform is.

Let’s put the situation into context:

You manage a stationery shop, which sells small items such as pencils, tape, and stickers.

This type of business typically has a retail structure that will benefit from high turnover because the profit margin for your items is small. Instead of identifying your products with the highest profit margin, you’ll do better if you opt to create a strategy based on sales frequency (how many times your customers come to shop) and sales quantity (how many they shop). This way, you’ll be able to optimize your resources to maximize your overall profits.

On the other hand, when you sell niche products and don’t have that much competition, focus on the amounts when you offer something unique. Profit should be your top priority. You don’t want to diversify your portfolio, so just continue investing in products that sell.

The approach is pretty straightforward for the previous examples. If you sell electronic products, you can either have a company that attracts big spenders (although they are few in number) or one that gets a lot of foot or website traffic. Either way, it benefits your bottom line–the sole difference is how your company wants to be perceived.

Become a retail mastermind you always wanted to be.